What Does Prf Insurance Mean?

The Single Strategy To Use For Prf Insurance

Table of ContentsIndicators on Prf Insurance You Need To KnowThe Single Strategy To Use For Prf InsuranceAbout Prf InsuranceExcitement About Prf InsuranceThe Best Strategy To Use For Prf Insurance

Farm as well as cattle ranch residential property insurance coverage covers the assets of your farm and ranch, such as animals, tools, structures, installments, and others. These are the usual protections you can obtain from ranch and also ranch property insurance.Your farm as well as cattle ranch makes use of flatbed trailers, confined trailers, or energy trailers to carry items and also tools. Business vehicle insurance will cover the trailer but only if it's affixed to the insured tractor or truck. If something happens to the trailer while it's not connected, then you're left on your very own.

Employees' settlement insurance offers the funds a worker can use to buy medications for a work-related injury or disease, as suggested by the medical professional. Employees' settlement insurance coverage covers rehab. It will additionally cover re-training expenses so that your employee can resume his work. While your staff member is under rehabilitation or being trained, the plan will certainly give an allowance equal to a percent of the typical once a week wage.

You can guarantee on your own with workers' compensation insurance coverage. While purchasing the policy, service providers will give you the liberty to consist of or omit yourself as a guaranteed.

Not known Facts About Prf Insurance

To get a quote, you can deal with an American Family members Insurance coverage representative, chat with representatives online, or phone American Family members 24 hours a day, 365 days a year. You can sue online, over the phone, or directly with your agent. American Family has stayed in business considering that 1927 and also is trusted as a provider of insurance coverage for farmers.

As well as, there are a couple of various kinds of farm truck insurance coverage available. The insurance coverage requires for every kind of vehicle vary. By spending just a little time, farmers can broaden their expertise about the different kinds of ranch trucks as well as select the very best and also most economical insurance coverage options for each.

Whatever provider is writing the farmer's vehicle insurance plan, hefty as well as extra-heavy trucks will certainly need to be placed on a business automobile policy. Trucks titled to a commercial ranch entity, such as an LLC or INC, will require to be positioned on a commercial plan regardless of the insurance coverage carrier.

Everything about Prf Insurance

If a farmer has a semi that is utilized for transporting their own ranch items, they may be able to include this on the exact same business vehicle policy that guarantees their commercially-owned pickup. If the semi is made use of in the off-season to transport the items of others, a lot of conventional ranch and also business auto insurance coverage providers will certainly not have an "hunger" for this kind of risk.

A trucking policy is still a commercial auto policy. Nonetheless, the service providers that provide insurance coverage for procedures with lorries made use of to carry products you can look here for third parties are usually focused on this kind of insurance. These sorts of procedures develop higher risks for insurance providers, larger insurance claim volumes, and also a better severity of claims.

A skilled independent representative can help you decipher the kind of policy with which your commercial vehicle need to be guaranteed as well as clarify the nuanced implications and insurance coverage effects of having multiple car plans with numerous insurance coverage service providers. Some vehicles that are made use of on the farm are insured on personal automobile plans.

Business cars that are not qualified for an individual automobile plan, but are utilized solely in the farming operations supply a lowered threat to insurance provider than their commercial usage counterparts. Some carriers decide to insure them on a ranch car plan, which will have a little different underwriting standards and also rating structures than a regular commercial automobile policy.

Prf Insurance Can Be Fun For Anyone

Numerous farmers relegate older or limited use vehicles to browse around this web-site this type of enrollment since it is an economical means to keep a car in use without every one of the additional costs commonly associated with cars. The Department of Transport in the state of Pennsylvania categorizes a number of different kinds of unlicensed ranch vehicles Type A, B, C, as well as D.

Time of day of use, miles from the house ranch, as well as other limitations relate to these sorts of cars. It's not an excellent suggestion to entrust your "day-to-day motorist" as an unlicensed ranch lorry. As you can see, there are multiple sorts of ranch truck insurance plan readily available to farmers.

The 10-Minute Rule for Prf Insurance

Disclaimer: Info and also claims presented in this material are meant for insightful, click for more info illustrative purposes as well as must not be thought about legally binding.

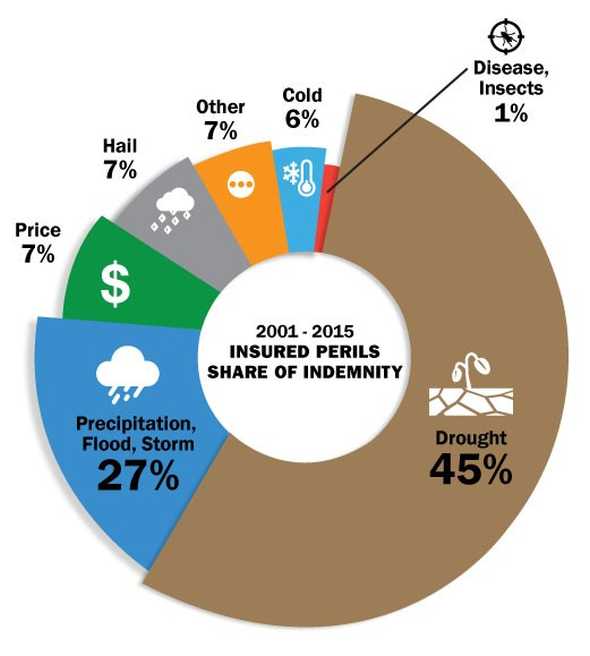

Crop hailstorm coverage is offered by private insurance providers and also regulated by the state insurance coverage divisions. There is a federal program giving a selection of multi-peril plant insurance policy products.

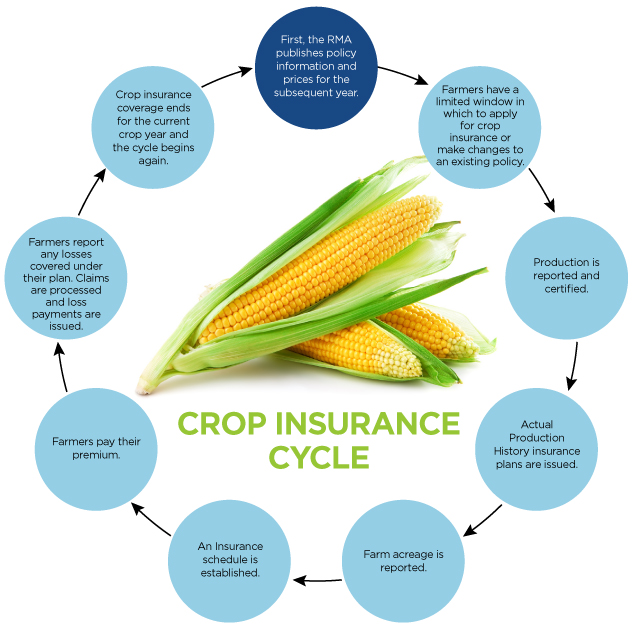

Unlike other kinds of insurance, plant insurance coverage hinges on established dates that put on all plans. These dates are figured out by the RMA ahead of the growing period and also released on its internet site. Days differ by plant and also by county. These are the important dates farmers should anticipate to fulfill: All plant insurance policy applications for the assigned region and also crop schedule by this date.